401k tax penalty calculator

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax. TIAA Can Help You Create A Retirement Plan For Your Future.

Is The Solo 401 K Better Than An Ira Llc Ira Checkbook Solo

Underpayment of Estimated Tax Penalty Calculator.

. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement. Use this calculator to estimate how much in taxes you could owe if.

Ad If you have a 500000 portfolio download your free copy of this guide now. In some cases its possible to withdraw from retirement accounts like 401 ks and individual retirement accounts before your retirement age without a penalty. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator.

As mentioned above this is in addition to the 10 penalty. Using the sales tax can also be a solution if you do not agree with the results of your audit of you want to appeal. If you are under 59 12 you may also be.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax obligation. Ad If you have a 500000 portfolio download your free copy of this guide now. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want.

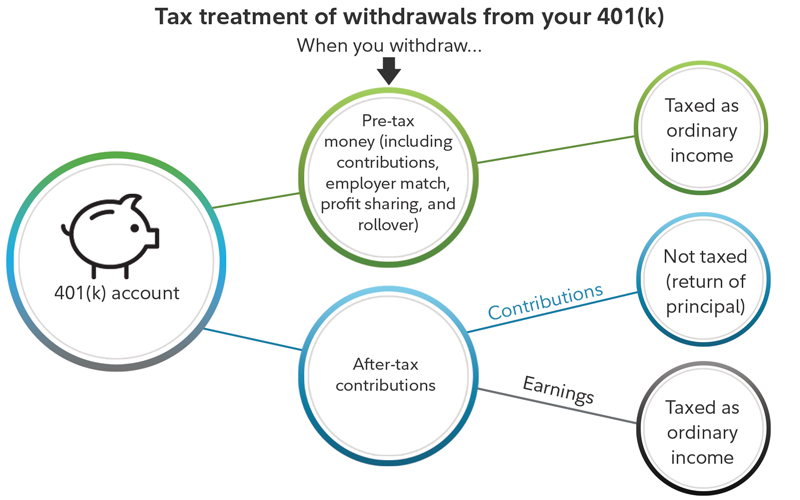

10 Best Companies to Rollover Your 401K into a Gold IRA. Distributions from your QRP are taxed as ordinary income and may. So if you take 20000 out of your 401 k before you reach 59 12 youll.

You may reduce future penalties when you set up a. A 401 k can be one of your best tools for creating a secure retirement. First all contributions and earnings to your 401 k are tax deferred.

Protect Yourself From Inflation. Our sole and only guarantee or warranty. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Underpayment of Estimated Tax Penalty Calculator. Discover The Answers You Need Here. NerdWallets 401 k retirement calculator estimates what your 401 k balance will.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Our IRS Penalty Interest calculator is 100 accurate. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds.

Dont Wait To Get Started. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Results. For example if you are looking.

Another aspect is covered in the. TaxInterest is the standard that helps you calculate the correct amounts. So if you withdraw the 10000 in your 401 k at age 40 you may get.

Enter the current balance of your plan your. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. If you start taking money out of your 401 k early youll pay taxes of 20 percent of what you withdraw.

If you cant pay the full amount of your taxes or penalty on time pay what you can now and apply for a payment plan. How We Calculate the Penalty We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a. It provides you with two important advantages.

We have the SARS tax rates tables. Using this 401k early withdrawal calculator is easy. Use this calculator to estimate how much in taxes you could owe if.

401k Withdrawal Tax Penalty Calculator. The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes. The money you withdraw from your 401k is taxed at your normal taxable income rate.

401 K Withdrawals What Know Before Making One Ally

Irs Fresh Start Program How Does It Work Infographic Irs Fresh Start Program Work Infographic

All About 401 K Retirement Plans Internal Revenue Code Simplified

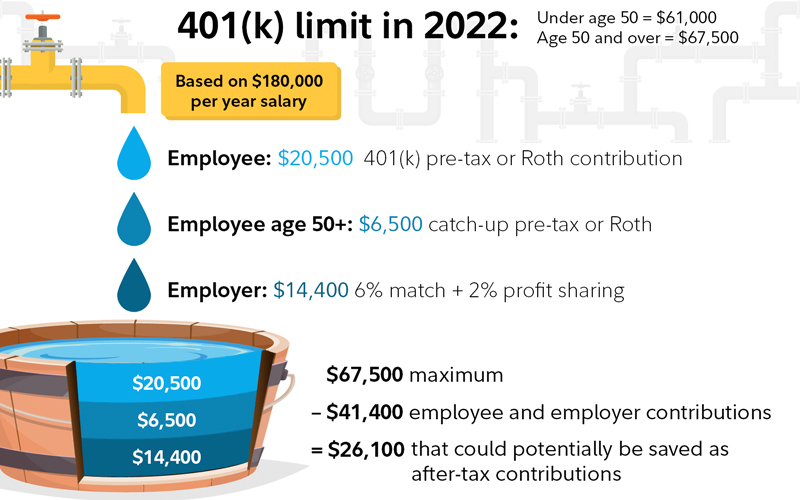

401 K Contribution Limits Rules And Penalties Castro Co

The Ultimate Roth 401 K Guide District Capital Management

Saving For Retirement The Importance Of Having A 401 K Marcus By Goldman Sachs

After Tax 401 K Contributions Retirement Benefits Fidelity

What Is The 401 K Tax Rate For Withdrawals Smartasset

Pin On Buying Selling A Home

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

401 K Plan What Is A 401 K And How Does It Work

What Are Stock Options How Do They Work Personal Capital Retirement Savings Calculator Retirement Planner Saving For Retirement

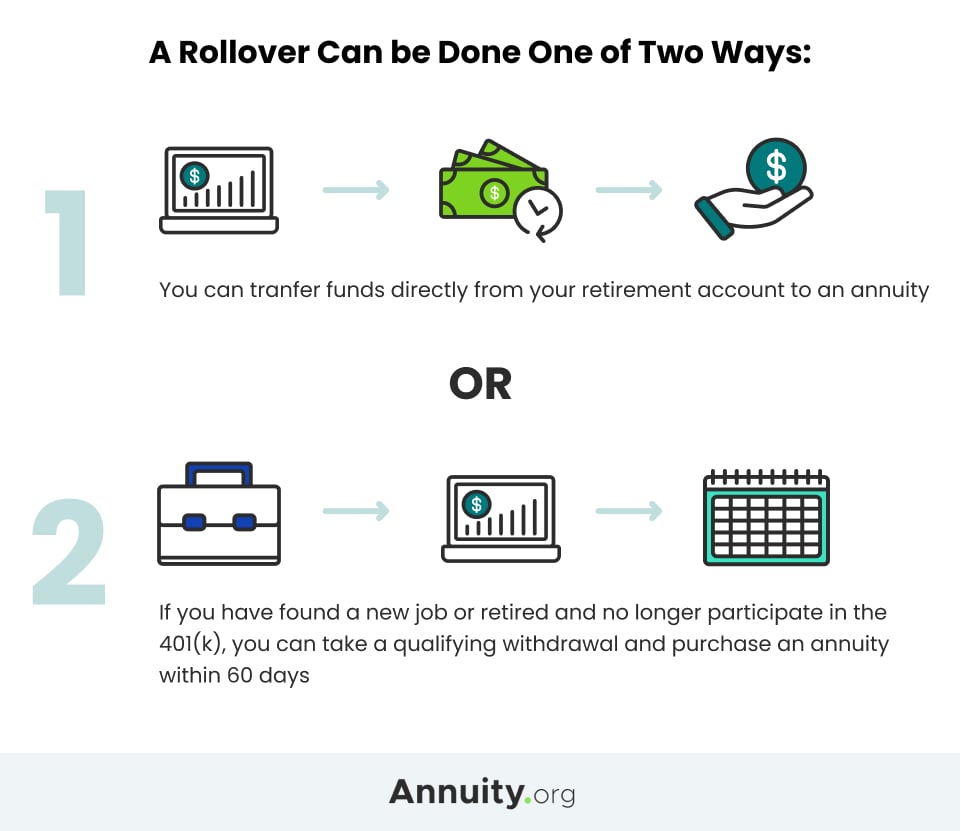

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

After Tax 401 K Contributions Retirement Benefits Fidelity

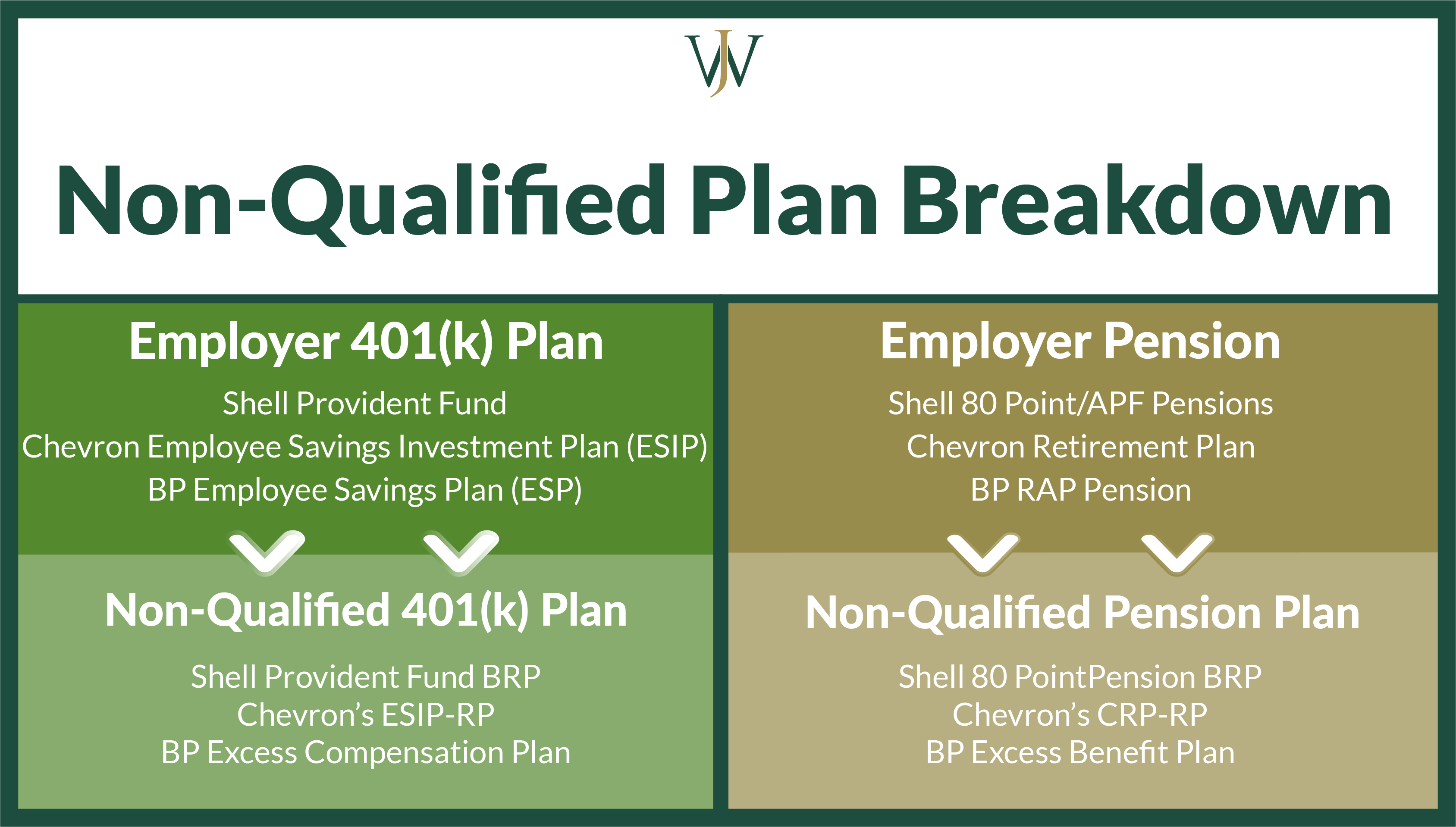

Tax Impacts Of Non Qualified 401 K Pension Benefits For High Income Earners

Should You Make Early 401 K Withdrawals Due

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent