Cost to profit ratio formula

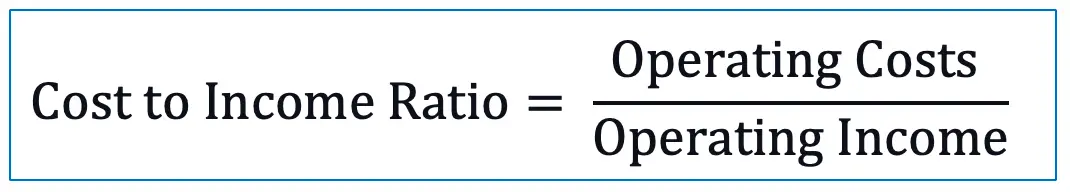

To calculate the cost revenue ratio you can use this formula. Solution With the cost to income ratio formula above we can calculate as below.

Gross Profit Margin Formula Meaning Example And Interpretation

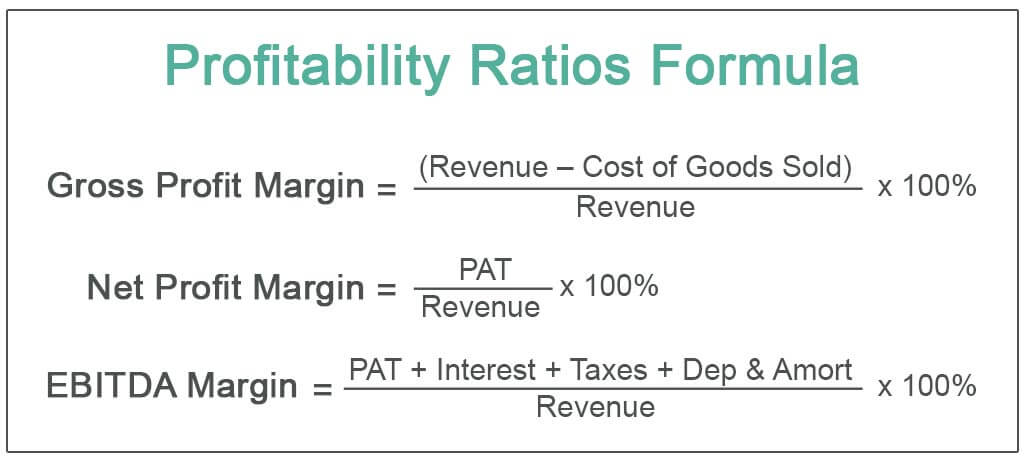

A Guide to Profitability Ratios.

. How to Calculate the Net Profit Ratio. You can calculate profit margin ratio by subtracting total expenses from total revenue and then dividing this number by total expenses. BCR 1000 1 0021 1000 1 0022 100 1 0023.

Cost revenue ratio cost of revenue total revenue. Compute the formula Solve for the PV of expected benefits using basic mathematical rules. It is similar to the ROE ratio but more all-encompassing in its scope since it includes returns generated from capital supplied by bondholders.

Operating costs USD 2389496 Financial income USD 8271503 Financial expenses USD. Cost of sales ratio formula. By dividing the total fixed costs by the contribution margin ratio the breakeven point of sales in terms of total dollars may be calculated.

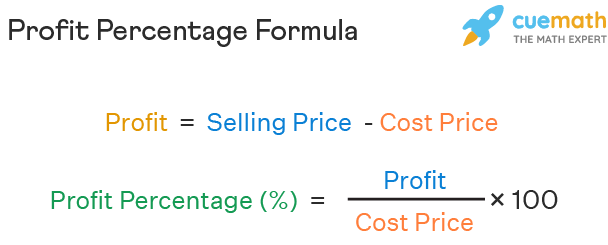

Cost of sales of the company and its operating expenses by its total revenue. Profit Total Sales Total Expenses Further the formula for profit can also be expressed in terms of each unit of production by deducting the cost price of production from the selling price. Calculate Net Profit Ratio from the below information.

NPM Net profit margin R Revenue CGS Cost of goods sold OPE. Below is the formula to calculate this profitability ratio- Gross Profit Margin Revenue Cost of Goods Sold Revenue100 2 Net Profit Margin Ratio The net profit called Profit. Or PV Ratio Fixed.

Answer We know Net Profit Ratio Net Profit Net Sales 100 Here Net sales Sales returns Net Profit Gross Profit Indirect. How to calculate the cost revenue ratio. Net profit Net.

Cost of sales divided by total value of sales X 100. The simplified ROIC formula. Cost to income ratio operating cost Operating income 175000430528100 4064 This ratio of 4064 implies that Sinra Inc.

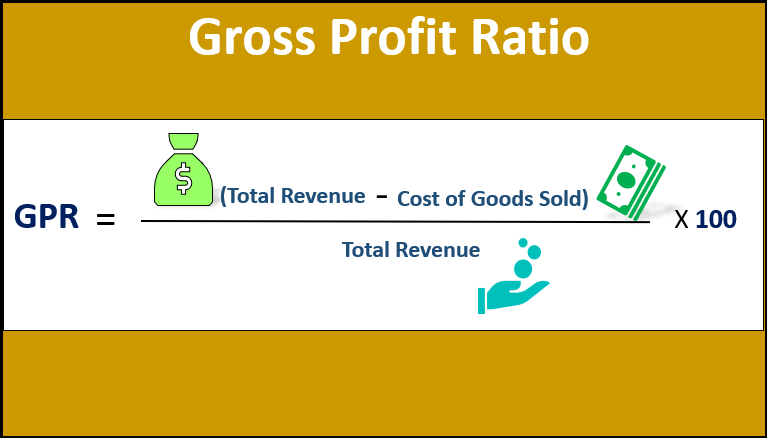

The formula for an operating ratio can be derived by dividing the sum of the cost of goods sold aka. Benefit-Cost Ratio is calculated using the formula given below Benefit-Cost Ratio PV of Expected Benefits PV of Expected Costs For Project A Benefit-Cost Ratio 229544057. With the help of above information we can compute the gross profit ratio as follows.

Made an expenditure of 4064 to generate operating. 235000 910000 02582 or 2582 Gross profit Net sales Cost of. For example a company with.

The formula for the net profit ratio is to divide net profit by net sales and then multiply by 100. The formula for calculating the cost of sales ratio is. PV Ratio Sales Variable costSales ie.

NPM R CGS OPE OTE I T R 100 or NPM Net income R 100 where. Since Contribution Sales Variable Cost Fixed Cost Profit PV ratio can also be expressed as. Cost of Goods Sold Opening Stock Purchases- Closing Stock Any Direct Expenses Incurred Purchases imply net purchases ie purchases minus purchase returns.

Gross Profit Margin Formula And Calculator Excel Template

What Is Gross Margin Definition Formula And Calculation Ig Uk

Profit Percentage Formula Examples With Excel Template

What Is The Gross Profit Margin Bdc Ca

Contribution Margin Ratio Revenue After Variable Costs

Gross Profit Percentage Double Entry Bookkeeping

Gross Margin Ratio Formula Analysis Example

Profitability Ratio Definition Formula Guide To Profitability Analysis

Gross Profit Ratio Top 3 Examples Of Gross Profit Ratio With Advantages

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Gross Profit Margin Formula Definition Investinganswers

Profit Formula What Is Profit Formula Examples Method

Cost To Income Ratio Formula Example Accountinguide

Profit Formula Profit Percentage Formula And Gross Profit Formula

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

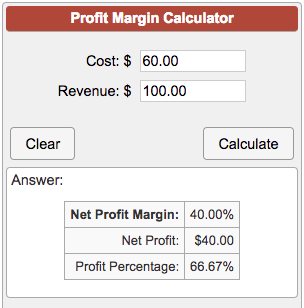

Profit Margin Calculator